43 403b vs 401k

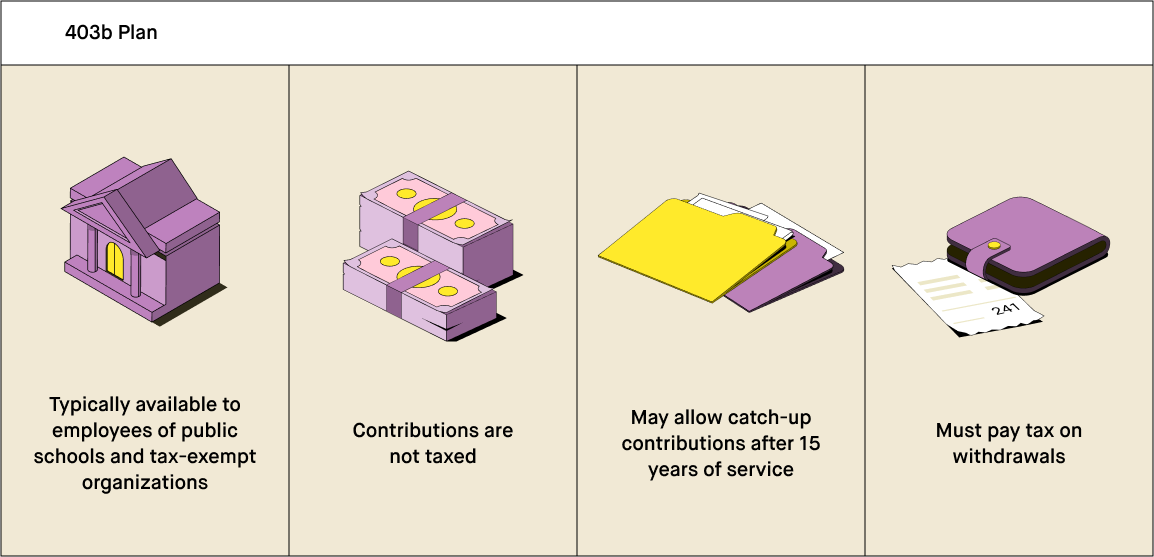

How a 403(b) is different from a 401(k) retirement plan ... Differences between a 401(k) vs. 403(b) plan. Eligibility. While 401(k) plans are offered by for-profit companies, 403(b) plans are offered by tax-exempt organizations like schools, ministries ... 403b vs 401k: Differences and Similarities - Brandon ... The primary difference between a 403b vs 401k retirement account is who uses them. A 401k is for people employed by a for-profit organization. In contrast, the 403 (b) plan is for those who work for a non-profit organization. Some typical examples include teachers, members of religious organizations, and hospital employees.

401(k) vs. 403(b): What's the Difference and Which is ... Another key distinction between 401 (k) plans and 403 (b) plans is that 403 (b) plans tend to have less regulatory oversight than 401 (k) plans. As both plans ran the congressional approval...

403b vs 401k

Difference Between 401K and 403B Retirement Plans (With ... The main difference between 401K and 403B retirement plans is that 403b is executable only if you are a part of any non-profitable organization like a hospital or an educational institute. However, a 401k retirement plan is applicable to all the employees whose organization is profitable and has its own set of advantages. 403(b) vs. Roth IRA: What's the Difference? 403(b) vs. Roth IRA: An Overview Both 403(b) plans and Roth IRAs are vehicles designated for use in retirement planning. A Roth IRA is a personal retirement planning vehicle that can be used by ... 403b Vs. 401k: What's The Difference? | Clever Girl Finance 403b accounts can only offer mutual funds and annuities, while 401ks can offer these plus other types of investments like individual stocks. This isn't that big a deal, since it's usually best to choose from a mix of mutual funds with either account. The 3-fund portfolio is a very simple and well-diversified way to invest in different asset types.

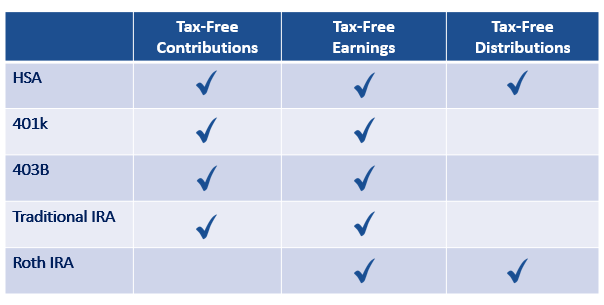

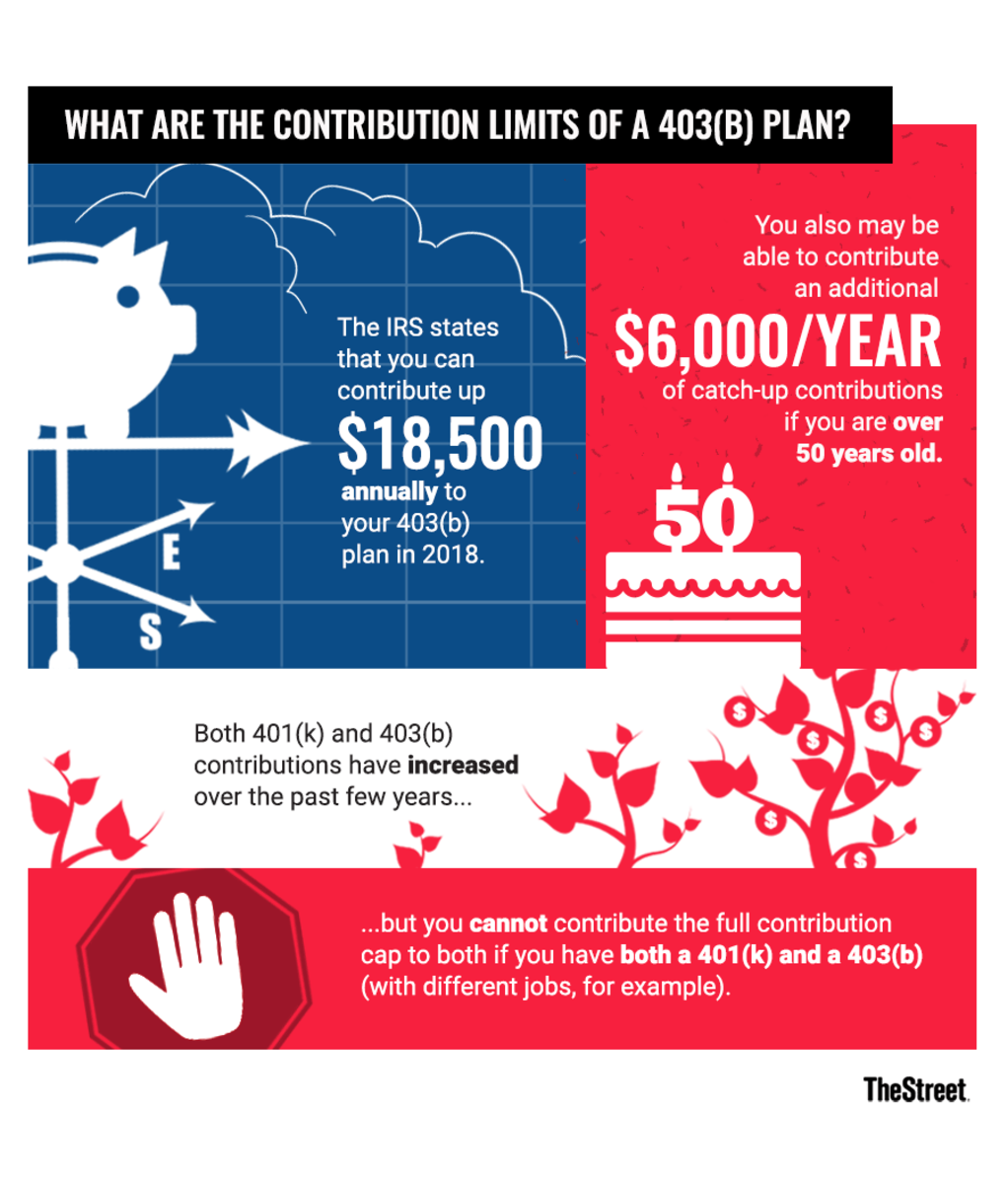

403b vs 401k. 401k vs. 403b: Differences, Advantages & Disadvantages ... Annual contribution limits for a 403b are identical to that of the 401k. Despite the many similarities, 403b plans do offer an advantage to users. If you work for an organization for 15 years or longer, you can contribute an extra $3,000 per year for five years. Main differences between the 401k and the 403b. Employer type 403(b) Plan vs. 401(k) Plan: What's The Difference ... A 403b, on the other hand, can only be offered by educational institutions and tax-exempt organizations. All employees are eligible to participate, but the employers may limit their participation rules more tightly than with a 401k. This applies to both government employers and non-profits. Contribution Limits 403(b) vs. 401(k): What's the Difference? | The Motley Fool The 401 (k) and 403 (b) are both tax-advantaged retirement accounts named after different sections of the tax code. While similar in many ways, 403 (b)s are offered only to public school employees,... 401(a) vs. 403(b) | What You Need to Know - SmartAsset Tax Benefits of 403(b) Plans. In terms of tax treatment, a 403(b) functions similarly to a 401(a). You make pre-tax contributions, and your money grows tax-free. However, you will owe regular income tax on eligible withdrawals. You can also make these at age 59.5. The 10% early-withdrawal penalty rule applies. 403(b) Plan Contribution Limits

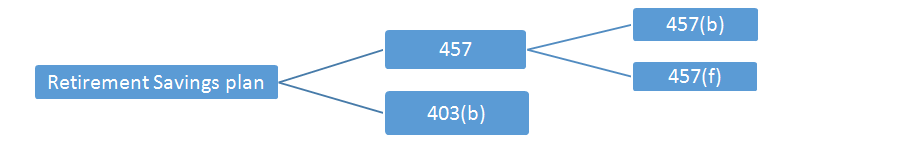

401k vs 403(b): What's the Difference? - Senior News Hubb Differences between 401k and 403 (b) Plans As I mentioned previously, the main difference between the two is the employer sponsoring the plans: 401k plans are offered by private, for-profit companies, while 403 (b) plans are only available to nonprofit organizations and government employers. What's the Difference Between a 401(k) and a 403(b)? The major difference between the two is that 403 (b) retirement plans are offered to those working at certain tax-exempt or not-for-profit organizations (like schools, certain educational institutions or hospitals) while 401 (k) plans are offered to employees at for-profit firms. But don't worry: Both great retirement savings options. 403b vs 401k Plans: What's Better For Retirement ... Another key difference is that 403b plans tend to have lower expense ratios, since they are subject to less stringent reporting requirements. This translates into lower fees or management costs for employees. Finally, 401k plans tend to be administered by mutual fund companies. 403(b) vs. 457(b): What's The Difference? - Forbes Advisor The 403 (b) has a much higher limit than the 457 (b), which lacks a separate contribution limit for employers. 457 (b)s only allow $20,500 in contributions from any source in 2022, whereas 403 (b ...

403b Vs. 401k: What's The Difference? - Forbes Advisor If your employer complies with ERISA and offers employer 403 (b) contributions, you may face a vesting period. This, however, is normally shorter than 401 (k) vesting periods. 403 (b) Contribution... 401k vs 403b - What's the Difference in these Retirement ... The difference in cost between a 401k and a 403b can be either small or substantial. Your cost will be determined by what you invest in, the level of service the management company provides, and who the company is. For example, a variable annuity in either plan will take a bite out of your earnings, as its associated fees are typically high. That said, 401k administrative costs can be much higher than those of a 403b, regardless of the investment inside. 403b vs. 401k: What's the Difference? - Good Financial Cents® The Difference between a 403b and a 401k. Most companies today offer employees a standard 401(k) retirement deferred savings plan. However, if a person works for the government or some organizations, like nonprofits, different options can come up, including the 403(b) plan. This raises the question of which is better between a 401(k) vs. 403(b). 403(b) Vs. 401(k): Comparison, Pros & Cons, Examples 403(b) vs. 401(k): At a glance Both 403(b) and 401(k) are employer-sponsored retirement plans aimed at helping workers invest their earnings and see them grow into a pot of money they can live on ...

PDF 2022 403(b) vs. 401(k) comparison chart Feature 403(b) 401(k) Subject to ERISA Yes if considered an "employee benefit plan." Employers often limit their role and do not provide employer contributions to the plan to remain exempt from ERISA. Could also be exempt under ERISA rules (governmental or certain church plans). Yes, unless otherwise exempt (governmental or certain church plans).

403(b) vs 401(k) - What's the Difference? How Are They the ... 401 (k) = For-profit / private companies 403 (b) = Tax-exempt organizations like public schools, hospitals, churches, etc. Are they the same thing as a "pension"? Same. Nope. Not at all. A pension is something totally different.

403b vs. 401k - What's the Difference? - Investor Junkie A 403 (b) plan is similar to a 401 (k). The major difference is a 403 (b) plan is used by non-profit companies, religious groups, school districts, and some government organizations. Most workplaces that qualify to offer a 403 (b) will not also provide a 401 (k). And for-profit corporations don't have the option of offering a 403 (b).

403(b) vs. 401(k): What's the Difference ... The main difference between a 403 (b) and a 401 (k) is the type of employer who offers them. 401 (k) plans are offered by private, for-profit companies, but 403 (b) plans are offered by nonprofit organizations. We'll unpack some other differences in a minute. First, let's take a look at each plan.

The Differences Between 401(k) and 403(b) Plans Notably, 401 (k) plans tend to be administered by mutual fund companies, while 403 (b) plans are more often administered by insurance companies. This is one reason why many 403 (b) plans limit...

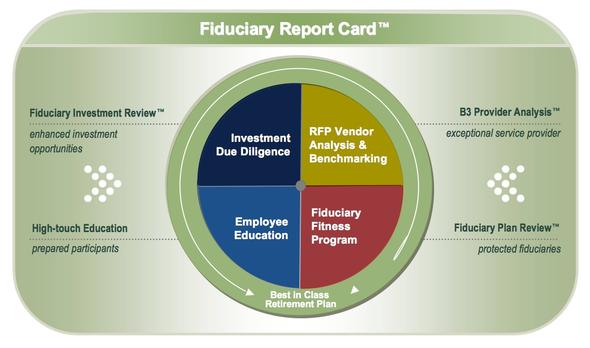

Navigating the Number Jumble: A 403(b), 401(k), and 457(b ... Over the years, through regulation changes and plan design mandates, the three predominant types of defined contribution retirement plans—403(b), 401(k), and 457(b)—have grown more similar. However, a number of key distinctions remain. Understanding the nuances between these plan types can be daunting.

Difference Between 401k and 403b | Difference Between 401k is a retirement plan for employees working in profit organizations, while 403b retirement plan caters for employees working in non-profit organizations, such as tax-exempted organizations-universities, colleges, and health organizations; employees of public schools, self-employed ministers and church employees.

403(b) vs 401(k) Accounts: What's the Difference? The two most common forms of retirement accounts for employees are the 401 (k) and 403 (b). The 401 (k) retirement plan is offered mostly by for-profit companies, while the 403 (b) is used by non-profits. Occasionally, they are both offered by the same employer. Learn the key differences so that you can choose between them if you need to.

How is a 403(b) different from a 401(k)? - Ultimate Guide ... The main difference is the type of employers who can offer them. Unlike 401 (k) plans which are offered by for-profit companies, 403 (b) plans are only available to employees of tax-exempt...

403(b) vs. 401(k) - What's the Difference? - SmartAsset 403(b) vs. 401(k): Differences. There are some noteworthy differences between a 403(b) vs. a 401(k). The most important is the types of companies that offer the two plans. For-profit companies offer 401(k) plans. Most people work at for-profit companies, meaning the majority of retirement plan participants use a 401(k.)

403b Vs. 401k: What's The Difference? | Clever Girl Finance 403b accounts can only offer mutual funds and annuities, while 401ks can offer these plus other types of investments like individual stocks. This isn't that big a deal, since it's usually best to choose from a mix of mutual funds with either account. The 3-fund portfolio is a very simple and well-diversified way to invest in different asset types.

403(b) vs. Roth IRA: What's the Difference? 403(b) vs. Roth IRA: An Overview Both 403(b) plans and Roth IRAs are vehicles designated for use in retirement planning. A Roth IRA is a personal retirement planning vehicle that can be used by ...

Difference Between 401K and 403B Retirement Plans (With ... The main difference between 401K and 403B retirement plans is that 403b is executable only if you are a part of any non-profitable organization like a hospital or an educational institute. However, a 401k retirement plan is applicable to all the employees whose organization is profitable and has its own set of advantages.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/agreement-and--discussion-1189829021-109d3b8bd8854ad1b0b7b981355d0571.jpg)

0 Response to "43 403b vs 401k"

Post a Comment